- Dapatkan link

- Aplikasi Lainnya

The concept of cash laundering is essential to be understood for those working in the financial sector. It is a course of by which dirty money is transformed into clean money. The sources of the cash in precise are criminal and the money is invested in a way that makes it appear to be clear cash and hide the identity of the legal a part of the cash earned.

While executing the financial transactions and establishing relationship with the brand new customers or maintaining present prospects the obligation of adopting ample measures lie on each one who is part of the group. The identification of such factor at first is simple to cope with instead realizing and encountering such conditions in a while within the transaction stage. The central financial institution in any nation offers full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present sufficient security to the banks to deter such situations.

Regulation 28 of the 2017 Money Laundering Regulations state that lawyers are required to conduct ongoing monitoring of a business relationship. The United Kingdom has one of the strictest and most highly developed set of laws on money laundering terrorist financing and fraud in the world.

Other laws relevant to money laundering are the Terrorism Act 2000 TACT which contains offences relating to terrorist.

United kingdom money laundering regulations 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Scrutiny of transactions undertaken throughout the course of the relationship including where necessary the source of funds to ensure that the transactions are consistent with the lawyers knowledge of the customer the customers business. 8-26 Chapter 1 Application regs.

The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017. 1 These Regulations may be cited as the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Chapter 4 of the consultation sets out proposals relating to the formation of limited partnerships and the reporting of discrepancies in beneficial ownership information.

Reforms of the suspicious activity reports regime and the supervisory regime are underway and our commitment to public-private partnership is embodied in the development of the Joint Money Laundering Intelligence Taskforce which continues. The Proceeds of Crime Act 2002 POCA and the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the Regulations are the principal laws used to prosecute money laundering. It has broadly defined money laundering.

On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. Financial services disputes and investigations. 2 These Regulations come into force on 26th.

The final version was laid in Parliament on 22nd June 2017 and came into force on 26th June 2017 thereby transposing 4MLD into domestic law. A draft of the Money Laundering Regulations 2017 MLRs can be found published alongside this consultation document. On 22 July 2021 HM Treasury published a consultation on proposed amendments to the Money Laundering Regulations 2017.

The Adelphi 111 John Adam Street London WC2N 6AU United Kingdom Money Laundering Regulations 2017 A public consultation issued by HM Treasury Comments from ACCA April 2017 Ref. The New Regulations bring into effect the UKs. Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017 No.

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory. Fraud and financial crime. The Money Laundering Regulations 2017 bring the latest international regulatory standards into UK law.

TECH-CDR-1535 ACCA the Association of Chartered Certified Accountants is the. 8-15 Regulation 9 Carrying on business in the United Kingdom. AML and counter-terrorist financing CTF.

The 2017 MLRs have been informed by the responses submitted and reflect the. Today the Money Laundering Regulations 2017 MLRs 2017 or Regulations has become effective transposing Fourth Money Laundering Directive EU 2015849 -. Litigation and dispute management.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 effective on 26 June 2017 aim to ensure that the UKs anti-money laundering regime implements the EU Fourth Money Laundering Directive and is in line with the Financial Action Task Forces standards and recommendations. Along with this legislation the United Kingdom has determined the obligations required by financial institutions to comply with the. Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations were published in 2017 after the POCA.

692 MLRs 2017 Part 2 Money Laundering and Terrorist Financing regs. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. The UK Government today published the final version of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the New Regulations.

9 Effects Of Money Laundering Summarized Download Table

Dashboard Of Suspicious Money Laundering Transactions Download Scientific Diagram

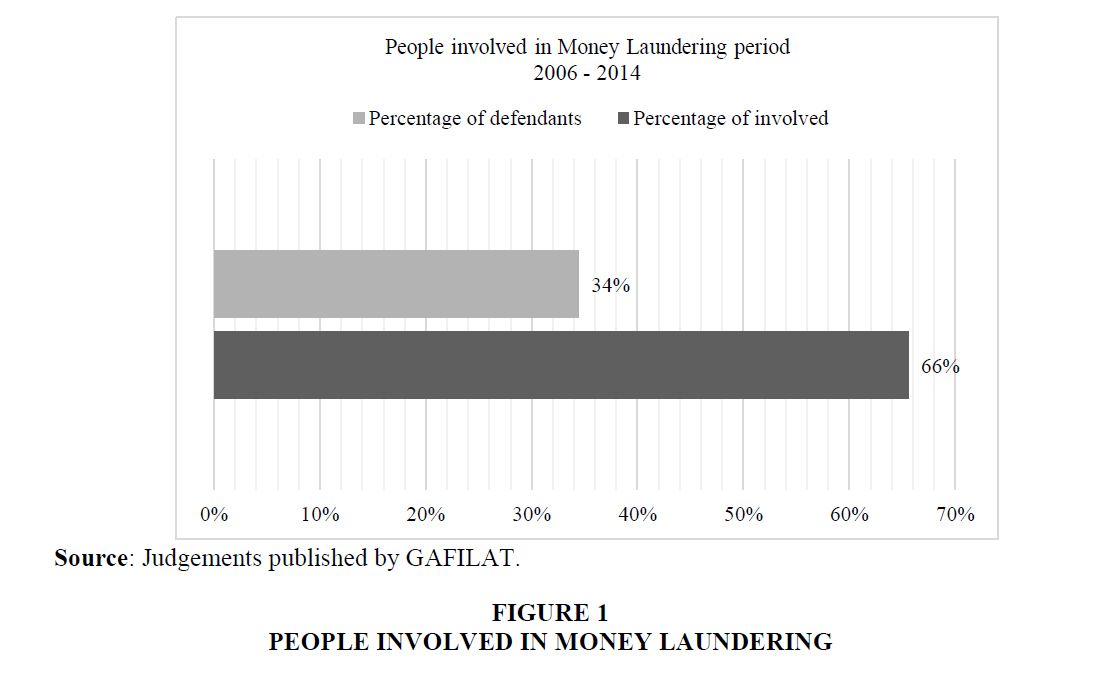

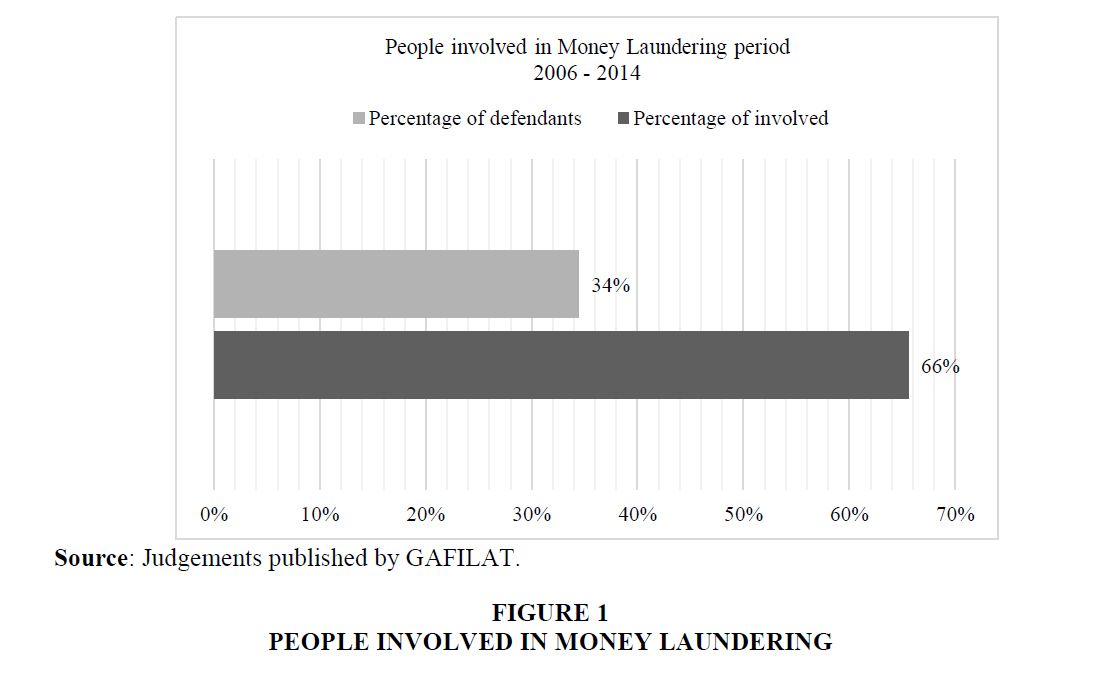

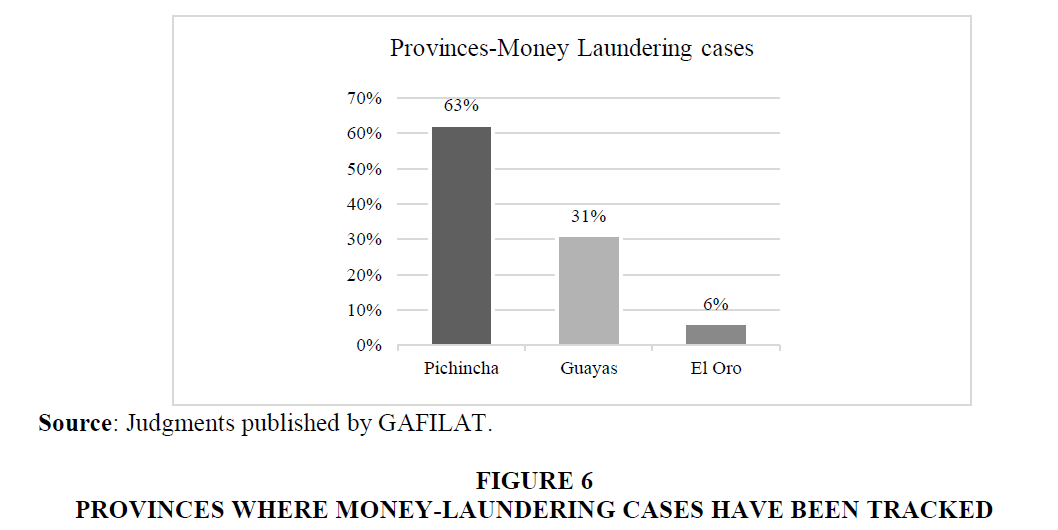

Money Laundering In Ecuador Profile Of The Involved Person And The Socio Economic Impact

Art Market In The Frame Of Money Laundering

Anti Money Laundering Europe Ame Eu Aml Twitter

Uk Taiwanese Regulators Weigh In On Bitcoin Laundering France Ponders Icos Bitcoin Crypto News Cryptocurrency Re Money Laundering Bitcoin Best Cryptocurrency

Brief Summary Of The Money Laundering Regulations 2017

Prevention Of Money Laundering Gov Si

Anti Money Laundering Ultimate Guide Training Express

Overview Of The Money Laundering Regulations 2017 Grl Landlord Association

Anti Money Laundering Compliance For Crypto Exchanges 2021 Update

Pdf International Anti Money Laundering Programs

Money Laundering In Ecuador Profile Of The Involved Person And The Socio Economic Impact

Pdf Anti Money Laundering Regulations And Its Effectiveness

The world of laws can appear to be a bowl of alphabet soup at occasions. US money laundering regulations are no exception. We now have compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending financial providers by decreasing risk, fraud and losses. Now we have big financial institution expertise in operational and regulatory threat. We now have a robust background in program administration, regulatory and operational danger as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many adverse penalties to the group due to the risks it presents. It will increase the probability of main risks and the opportunity value of the bank and ultimately causes the bank to face losses.

- Dapatkan link

- Aplikasi Lainnya

Komentar

Posting Komentar