- Dapatkan link

- Aplikasi Lainnya

The idea of cash laundering is essential to be understood for those working within the monetary sector. It is a process by which dirty cash is transformed into clean cash. The sources of the money in precise are felony and the money is invested in a way that makes it look like clean cash and conceal the id of the felony part of the money earned.

Whereas executing the financial transactions and establishing relationship with the new prospects or sustaining existing clients the responsibility of adopting sufficient measures lie on every one who is a part of the organization. The identification of such aspect at first is simple to cope with as a substitute realizing and encountering such situations later on within the transaction stage. The central financial institution in any country provides full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient security to the banks to deter such situations.

Money laundering in Mauritius is not a serious problem. Mauritius is one of the first countries in Eastern and Southern African Anti-Money Laundering Group ESAAMLG Region to develop an anti-money laundering and the combating of terrorist financing AMLCFT regime.

Cami Career Path In 2021 Career Path Career Money Laundering

42 74 of the respondents believe that there is a severe problem of money laundering in Mauritius.

Money laundering cases in mauritius. This was published in its annual report 2006 and was helpful for this study. Cases of money laundering in Mauritius will be studied and analysed. Veeshal Lolldharawo appeared before the Pamplemousses court.

Mr Geoffrey Cox QC for the State of Mauritius invites the Board to consider the statute against its background of international pressure to combat economic crime and money laundering including recommendations that cash transactions should be closely monitored and controlled. I The Convention on Offences and Certain Other. The authoritative version is the one published in the Government Gazette of Mauritius THE FINANCIAL INTELLIGENCE AND ANTI-MONEY LAUNDERING ACT 2002 Act 62002 Proclaimed by Proclamation No.

43 Proceeds of drug related offences and corruption were seen to be the main crime for money laundering purposes. Anti Money Laundering AML in Mauritius. 3 106 Mauritius is a founder member of the Eastern and Southern Africa Anti-Money.

Interpretation PART II - MONEY LAUNDERING OFFENCES 3. 2 Subsection 1 shall not apply to an exempt transaction. The former prime ministers arrest followed those of Mallam-Hasham a week earlier on counts of using his public office for gratification and money laundering and.

Obtained in Mauritius as regards anti-money laundering. Neither has Mauritius. Click to Launch Free Tutorial.

31 of 2002 wef. However the regime has not kept pace with the. Since October of last year the Investigation Division of ICAC has started to focus its actions on the investigation of money laundering related to drug trafficking.

Key principles from the anti-money laundering act and from regulations imposed by bank regulators eg. While reviewing the literature it was noticed that for Mauritius the only local survey done was by the FIU in 2006. In addition Nitesh Gurroby was arrested by the ICAC on a provisional charge of money laundering under section 3 of the Financial Intelligence and Anti-Money Laundering Act.

The Money Laundering Reporting Officer MLRO 66 INTERNAL REPORTING PROCEDURES AND RECORDS 67. 10 June 2002 ARRANGEMENT OF SECTIONS Section PART I. He is responding to a charge of money laundering under Clause 3 1 of The Financial Intelligence and Anti-Money Laundering FIAMLA.

Money Laundering- A Case study on Mauritius. A healer in the ICACs net. 1 Notwithstanding section 37 of the Bank of Mauritius Act 2004 but subject to subsection 2 any person who makes or accepts any payment in cash in excess of 500000 rupees or an equivalent amount in foreign currency or such amount as may be prescribed shall commit an offence.

While Mauritius has over the years made considerable progress in the field of anti-money laundering and combatting the financing of terrorism AMLCFT it was nonetheless placed on 21 February 2020 on the FATFs list of jurisdictions under increased monitoring due to five remaining deficiencies in its AMLCFT regime. One under the supervision of the National Coast Guard will be oriented to the port of Port-Louis the other will be under the responsibility of the ICAC. The main aim of this study is to assess the perception of money laundering among the Mauritian population.

Similarly the Mauritius Police Force and the Mauritius Revenue Authority are multiplying their efforts to track down those involved in this fight. Many aspects of the siphoning of the NPF money and its disappearance still remain an issue and it is high time that the public should know what happened to the taxpayers money. FATF Methodology for assessing technical compliance with the FATF Recommendations and the Effectiveness of AMLCFT systems.

This is most troubling because such measures are especially necessary to prevent money-laundering. 12062020 - 1841 Mauritius has over the years built a thriving and trustworthy financial sector. Ramgoolam is to have committed fraud by falsely stating that the buyer was a Mauritian citizen.

ESAAMLG Mutual Evaluation of Mauritius 2018 including executive summary and ratings tables. The country has taken several important steps over the past ten years to enact legislation that has strengthened the countrys money laundering and terrorist financing prevention efforts. Financial Services Commission and the Bank of Mauritius will be outlined.

Danger looms for Mauritius destined for EUs money laundering blacklist Issued on. Earlier report on Mauritiuss efforts to combat money laundering and terrorist financing. He also claimed that he never declared his income to the Mauritius Revenue Authority MRA.

44 Between 60 to 70 of the of the respondents rated the gaming sector to be most exposed to money laundering activities. Following the decision of the Financial Action Task Force FATF at its Plenary Meeting of 19-21 February 2020 to include Mauritius on its list of jurisdictions under increased monitoring and the listing of the country on the EU List of High Risk Third Countries issued by the European Commission on 7 May 2020 Parliament passed the Anti-Money Laundering and. The mechanism of transferring huge sums of money notably for tax evasion has long been a complex process requiring intermediaries like the infamous Swiss Banking System.

Case may be the following United Nations Conventions.

.jpg)

The Top Money Laundering Cases In Recent Times

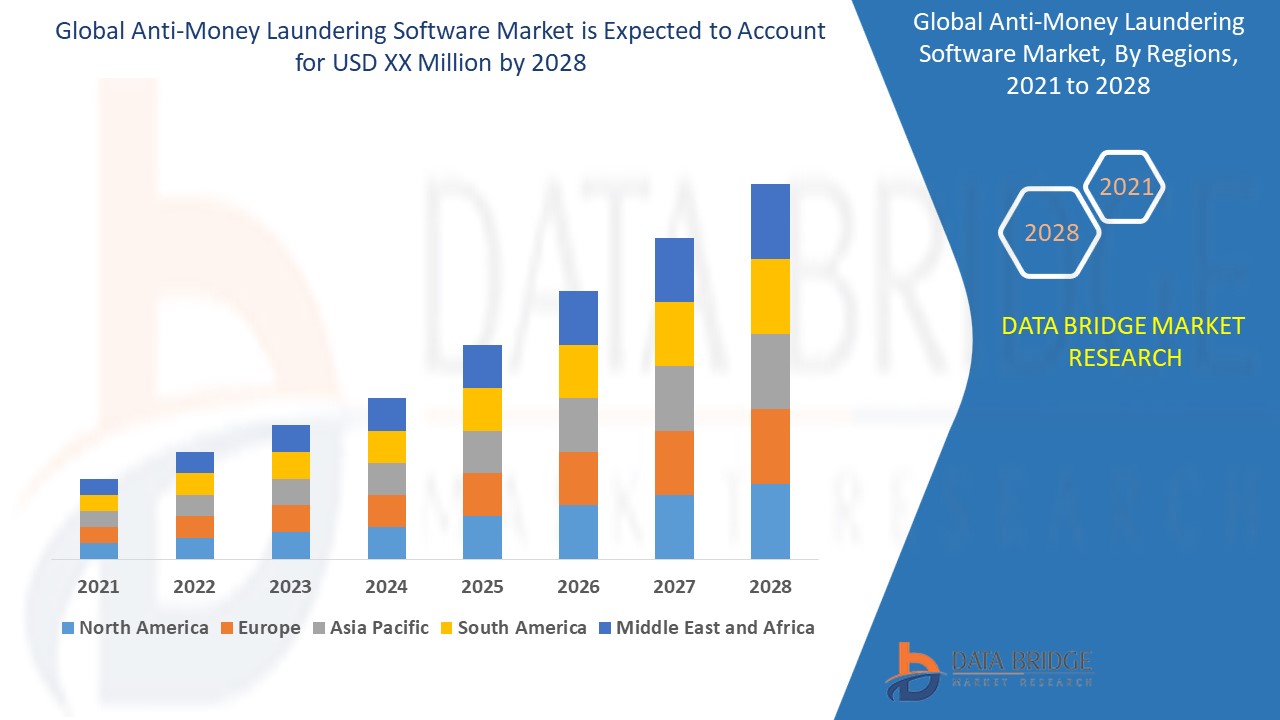

Anti Money Laundering Software Market Global Industry Trends And Forecast To 2028 Data Bridge Market Research

Pdf Dirty Money The Evolution Of International Measures To Counter Money Laundering And The Financing Of Terrorism 4th Edition

Anti Money Laundering 2021 Liechtenstein Iclg

Money Laundering Why It S Bad For Society Business And The Economy

Aml Certification In Kenya Regtechtimes

Corruption And International Money Laundering Maxi Operation Between Italy France And Switzerland Two Professionals Arrested Kidnappings For 15 Million Breaking Latest News

Doc How Big Is Global Money Laundering John Walker Academia Edu

Anti Money Laundering International Law And Practice Wiley

Casino Govt Regulations Include Safeguards Designed To Prevent Money Laundering By Junkets Infographic Money Laundering Prevention Infographic

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

What Is Money Laundering And How Is It Done

Pdf Dirty Money The Evolution Of International Measures To Counter Money Laundering And The Financing Of Terrorism 3rd Edition

The world of laws can seem like a bowl of alphabet soup at times. US cash laundering laws are no exception. We have now compiled an inventory of the top ten cash laundering acronyms and their definitions. TMP Risk is consulting firm focused on protecting financial providers by decreasing risk, fraud and losses. We've got large bank expertise in operational and regulatory danger. Now we have a strong background in program management, regulatory and operational risk as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many adverse penalties to the group as a result of dangers it presents. It will increase the likelihood of main dangers and the opportunity cost of the bank and finally causes the bank to face losses.

Komentar

Posting Komentar