- Dapatkan link

- Aplikasi Lainnya

The idea of cash laundering is essential to be understood for those working in the financial sector. It's a course of by which dirty money is converted into clear cash. The sources of the cash in precise are legal and the cash is invested in a means that makes it seem like clear cash and hide the identification of the criminal a part of the money earned.

While executing the monetary transactions and establishing relationship with the brand new customers or maintaining present clients the obligation of adopting sufficient measures lie on every one who is a part of the group. The identification of such ingredient to start with is simple to cope with as an alternative realizing and encountering such situations in a while within the transaction stage. The central financial institution in any nation offers complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such situations.

Reference for that purpose should be made to the appropriate statutory provisions. We also provide policy templates and procedures for the UK GDPR AML.

Our Training Materials for FCA GDPR AML mean that firms can deliver their own in-house training for a low one-off cost.

Fca handbook aml training. A firm must ensure the policies and procedures established under SYSC 611 R include systems and controls that. This guidance is less relevant for those who have more limited anti-money laundering AML responsibilities such as mortgage brokers general insurers and general insurance intermediaries. Examples of poor practice.

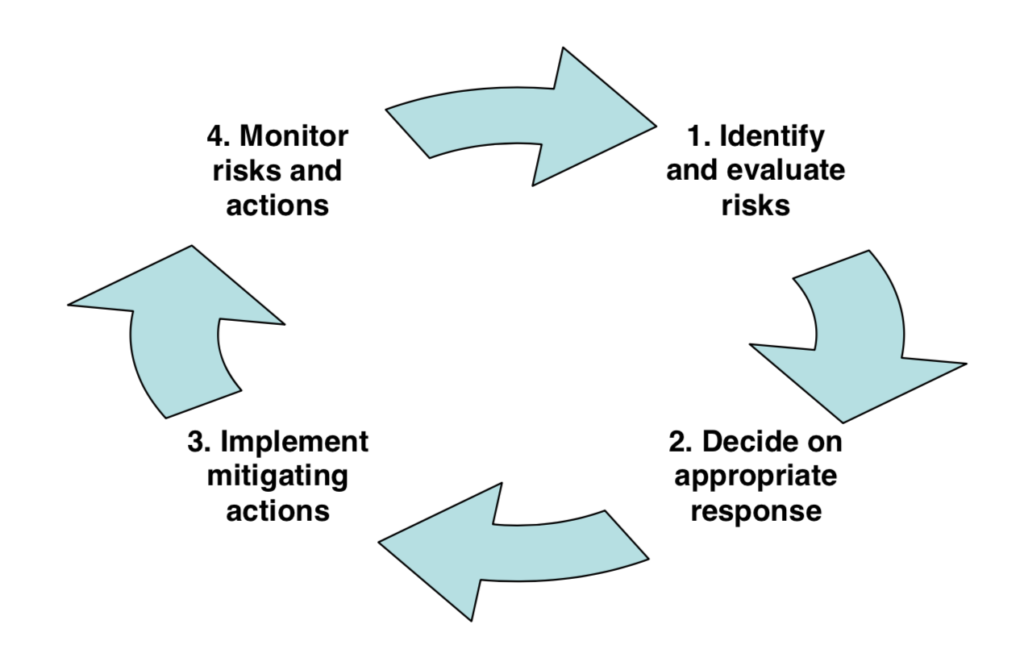

Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. Our training and competence regime supports consumers by making sure the financial services workforce is appropriately qualified and well regulated. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive.

The handbook provides general guidance on key anti-money laundering and combating the financing of terrorism AMLCFT requirements. Know Your Compliance Limited specialise in developing FCA Policy Templates and regulatory compliance policies procedures checklists and training packages. Reviewing AML policies and procedures as a one-off exercise.

And the importance therefore of firms having adequate customer due diligence measures in place. This page highlights some specific new areas that firms need to comply with. Money laundering risk is the risk that a firm may be used to further money laundering.

Firms must have in place policies and procedures in relation to customer due diligence and monitoring among. The FSA visited 43 firms in total and gathered additional information from approximately 90 small firms with a survey. The risk-based approach to anti-money laundering.

Examples of good practice. Training and competence. This handbook is intended to assist NBFIs in developing and implementing policies and procedures to combat money laundering and the financing of terrorism.

The report explored in depth a number of key areas that required improvement including a review of staff training and the need to ensure staff are aware that it is a constant requirement to ensure. The report flagged up concerns relating to. Are comprehensive and proportionate to the nature scale and complexity of its activities.

Ad Find your search here. FCTR 1015 G 13122018. The review emphasised the key role that the small firms sector often plays in acting as the first point of entry for customers to the wider UK financial services industry.

HIRETT LTD has implemented a comprehensive Anti-Money Laundering and Financial Crime training program to ensure that all staff in particular individuals responsible for transaction processing andor initiating andor establishing business relationships undergo AML knowledge competency and awareness training. Suitable for those looking to comly with the FCA Handbook rules or to gain FCA authorisation. One large firms procedures required it to undertake periodic Know Your Customer KYCCustomer Due Diligence CDD reviews of existing clients.

FCTR 531 G 13122018. Complete with slides notes training templates. Fca Handbook Aml Compliant Business Management Independent Financial Adviser Information Update Products Services Advisers Miss the new PROD Rules Quoted Post.

FCTR 513 G 13122018. One firm told us that training was de-livered as part of an induc-tion programme but not re-freshed at regular intervals throughout the employee. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force.

ANTI-MONEY LAUNDERING AND COUNTERING THE FINANCING OF TERRORISM HANDBOOK October November 2019 Whilst this publication has been prepared by the Financial Services Authority it is not a legal document and should not be relied upon in respect of points of law. Ad Find your search here. Some medium-sized and small firms admitted that staff AML training was an area where improvement was needed.

Find info on TravelSearchExpert. But it may still be of use for example to assist them in establishing and maintaining systems and controls to reduce the risk. Check out results for your search.

07012021 See all updates. Information contained in the handbook should be adapted to. The depth of the review is determined by the risk.

A high-level competence requirement the competent employees rule that. FCG 313 13122018. Check out results for your search.

The risk-based approach means a focus on outputs. The Joint Money Laundering Steering Group Guidance written by the industry and endorsed by the Treasury is readily available to provide firms with practical help in meeting their legal and regulatory obligations in the areas of both anti-money laundering and terrorist financing. Firms implementation of a risk-based approach to AML.

Ad Search for Aml training course at TravelSearchExpert.

Https Www Handbook Fca Org Uk Form Sup Sup 10a Ann 04 Long A Mifid Uk 20170130 Pdf

Anti Money Laundering Ppt Download

Demystifying The Fca S Demands A Detailed Guide For The Uk S Aml Requirements Sumsub Com

Https Www Handbook Fca Org Uk Form Sup Sup 10c Ann 05 Sor Uk Relevant Persons 20181101 Pdf

What Does The Fca Mean Ready Willing Organised Fca Authorisation Speci Fca Organization Financial Services

Https Www Handbook Fca Org Uk Form Sup Sup 10c Ann 03 Long A Uk 20181210 Pdf

Risk Control Sysc 7 1 Fca Handbook Fca Authorisations And Compliance Financial Conduct Authority

Anti Money Laundering Ppt Download

Fca Template Compliance Guidelines Manual

Fca Handbook Prin Principles For Businesses Fca Authorisations And Compliance Financial Conduct Authority

Https Www Handbook Fca Org Uk Form Sup Sup 10a Ann 04 Long A Uk 20180629 Pdf

Fca Employee Handbook Financial Conduct Authority

The world of rules can seem to be a bowl of alphabet soup at instances. US cash laundering laws are not any exception. We have now compiled a list of the top ten cash laundering acronyms and their definitions. TMP Danger is consulting agency targeted on defending financial providers by decreasing danger, fraud and losses. We have now huge bank expertise in operational and regulatory risk. We've a strong background in program management, regulatory and operational risk in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many adversarial penalties to the group because of the dangers it presents. It increases the probability of main risks and the opportunity price of the bank and in the end causes the financial institution to face losses.

Komentar

Posting Komentar